If you are a prime contractor Control Account Manager (CAM), how do you plan Budgeted Cost for Work Scheduled (BCWS) and claim Budgeted Cost for Work Performed (BCWP) when the negotiated subcontract value you are assigned to manage differs from your control account budget?

If you are a prime contractor Control Account Manager (CAM), how do you plan Budgeted Cost for Work Scheduled (BCWS) and claim Budgeted Cost for Work Performed (BCWP) when the negotiated subcontract value you are assigned to manage differs from your control account budget?

First, let’s understand the facts. You are assigned to manage a deliverable hardware subsystem reporting element in the contract work breakdown structure that will also be reported in the Integrated Program Management Report (IPMR). The history of your subcontract is:

- The subcontractor proposed a total price of $110M (Cost $102M and Fixed Fee $8M).

- For various reasons, your program manager believed that the final subcontract could be negotiated for 18% less than the proposed price, so your authorized budget is $90M (including fee).

- You placed the authorized budget in a planning package until the completion of subcontract negotiations.

- The subcontractor will report its IPMR data at the total price level (including fee).

- The subcontract was negotiated for a total price of $100M (Cost $95M and Fixed Fee $5M).

- You requested that the program manager make up the budget difference from Management Reserve (MR), but the program manager declined.

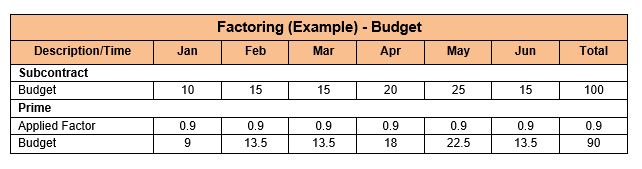

Factoring the subcontractor’s data is the best approach in this situation. Factoring the subcontractor’s data simply means applying a consistent multiplier to the subcontractor’s budget values: Budgeted Cost for Work Scheduled (BCWS) and Budget at Completion (BAC). The multiplier is developed by dividing the available control account budget by the subcontract price. In the example, the multiplier is .9 and was derived by dividing the CAM’s budget of $90M by the total subcontract value for the hardware system of $100M. This multiplier is applied to the time-phased budget provided by the subcontractor as shown in the table below. This factored budget becomes the prime contractor’s control account budget.

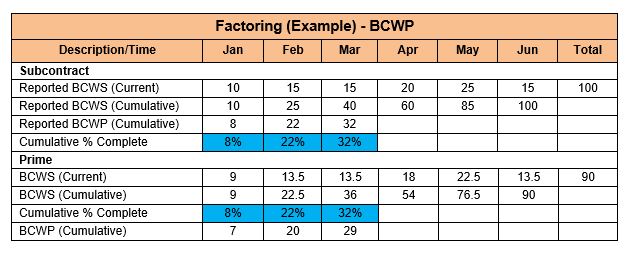

The calculation of the prime contractor’s earned value, also known as the Budgeted Cost for Work Performed (BCWP), simply requires applying the same factor to the subcontractor’s cumulative BCWP each month as shown in the table below. In the example, for the month of March, cumulative subcontractor BCWP of 32 multiplied by the factor of 0.9 yields the prime contractor’s factored BCWP of 29. When calculating the BCWP, the value in the prime contractor’s Earned Value Management System must reflect the same percent complete (BCWP/BAC x 100) as the subcontractor’s reported data; this is illustrated by the highlighted cells in the data example.

Note that factoring does not apply to Actual Cost of Work Performed (ACWP), the Estimate to Complete (ETC) or the Estimate at Completion (EAC) because those values represent actual costs rather than budgeted amounts that must reconcile with the subcontract Target Cost.

Factoring can occur whether the prime contractor’s budgeted amount for the subcontract effort is either greater or less than the subcontract negotiated price. Another instance where factoring is appropriate is when the subcontractor provides IPMR data without fee. The subcontractor’s fee is a cost to the prime contractor and should be included in the prime contractor’s Performance Measurement Baseline (PMB), so factoring is an appropriate technique in this situation.

In summary, remember the following when factoring subcontractor data:

- Factoring ensures that the subcontract factored BCWS equals the prime contractor’s budget.

- The prime contractor’s factored BCWP must yield a percent complete consistent with the subcontractor’s percent complete.

- Factoring does not apply to the ACWP, ETC or the EAC.

Thank you for reading our blog. You can also sign up for our EVMS Newsletter. Give Humphrey’s & Associates a call with questions or to inquire about our classes, certifications and services.

{ 2 comments… read them below or add one }

I would like to see you take this topic further by discussing how to report cost and schedule variances in these situations.

Thanks Tom, that’s a good suggestion, we will put that on our list. Chris Humphreys