Earning Value for Material – The Correct Approach – Part 2

Last Updated May 22, 2025

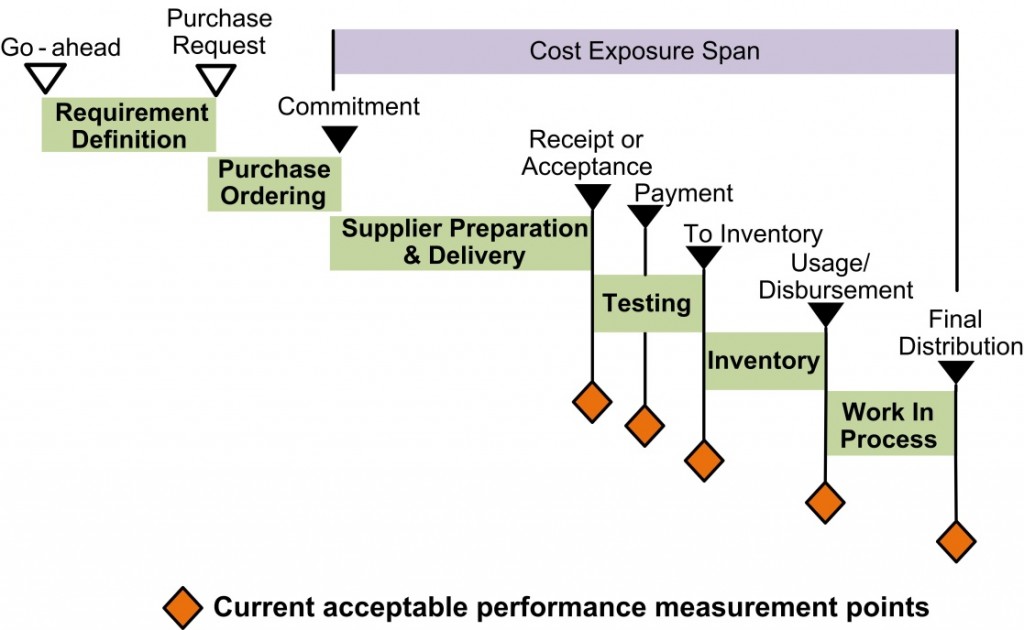

Recall from the previous blog about earning value for material, in which Guideline 21 in the EIA-748-D Standard1 for Earned Value Management Systems (EVMS) states that earned value is measured “…at the point in time most suitable for the category of material involved, but no earlier than the time of actual receipt of material…”

In that previous blog, two high-level types of material categories were discussed for illustration purposes. A common follow on question is “When Guideline 21 mentions category of material, are there pre-set categories of material that companies should use?”

The answer: Material categories are unique to each company, though companies may have general similarities to others in the same line of business. It is also dependent on whether a company has non-production or production type contracts (or both). In the previous blog topic, Engineering Material and Production Material were used as generic examples for material categories assuming a company has some level of production activity.

Even if a company is not a production (or manufacturing) facility, if they have material that sits in inventory for an extended length of time (generally longer than two months), the earned value point should be different from that of engineering (or receipt) type material. Some companies describe their material categories as “receipt type material” and “inventory type material.”

A company’s Earned Value Management (EVM) System Description should describe the various categories of materials that are typical in their line of business.

The easiest type of material category to describe is “tangible” material – objects you can physically touch. This includes items used to build the final product, such as ribs, spars, and bulkheads, wiring harnesses, tubing, pumps, switches, actuators, brakes, hinges, and the like. It can also include major assemblies and subcomponents outsourced to suppliers, like wings, control surfaces, canopies, and doors. Engines are material if purchased under the contract; if they are provided as government-furnished equipment (GFE), they are not part of the material element of cost.

Ancillary materials used during the manufacturing process also fall under the material category. These include items such as paint, caulk, glue, nuts, bolts, rivets and similar components.

All the items listed above fall into a category called “recurring” material. These are materials that are purchased repeatedly and are essential to building the final product.

Another important material category – separate from the components used in the final product – is the tools and fixtures used in the factory to build up the product (excluding capital assets). If purchased under the contract, they are considered part of the material element of cost. Unlike recurring materials, these items are typically purchased once and are used to build many finished products. This type of material is referred to as “non-recurring.”

Some contracts include the acquisition of spares to support the finished product after delivery. If spares are purchased, they count as material. If the spares are manufactured in the contractor’s factory alongside the finished product, the constituent materials that go into the spares also fall under material element of cost.

What about major suppliers? If a major supplier provides a tangible product such as a radar or landing gear, the cost of that subcontract is a material cost. However, the cost of a supplier providing non-tangible products (such as engineering services) is usually classified as a labor expense rather than material.

When dealing strictly with materials used for engineering and/or production related effort, a number of approaches to claim earned value may be needed. This is based on the products a company typically builds for their government customer. Various materials could also have different handling requirements, including bonded stores, with different rules for use, issue, transfer, borrow/payback and so forth. As a result, the various types of materials may have different methods for planning and use and could all use different earned value techniques.

Another consideration when determining the appropriate earned value techniques for production environments is the approach used to determine what is classified as high value material, critical material, and low value material.

- High value material and critical material should be planned and earned using discrete earned value techniques

- Low value material may be planned and earned as apportioned effort or as level of effort (LOE), as well as being discretely measured

- Low value material may be planned as items in aggregate, or in homogeneous groupings (e.g., lubricants, fastening hardware, bar stock, coatings, etc.).

H&A recommends ensuring your EVM System Description provides the appropriate guidance to project teams on how to properly plan for the various material categories and acceptable earned value techniques that should be used as well as the appropriate earned value points (such as receipt or issue) for the category of material involved.

Also see these related blogs:

- EVM Material Earned Value – Price vs. Usage Variance Analysis – Part 3.

- Earned Value Management Systems (EVMS) – Residual Material Accountability – Part 4.

- Aligning ACWP with BCWP for EVM | Earned Value Management.

- EVMS compliance: Material Transfers and Loan/Paybacks.

Do you need an independent review your EVM System Description to ensure you are providing the necessary guidance to your project teams? Humphreys & Associates has the earned value management experts to assess your EVM System Description and provide recommendations to improve the content. Contact us today.

- EIA-748-D Guideline 21 content maps to the EIA-748-E Guidelines 14 and 16 which streamlined the content in D Guideline 21. EIA-748-E Guideline 14 states in part: “Earned value for material items may not be credited earlier than the actual receipt of the material nor later than the consumption of the item.” ↩︎

Earning Value for Material – The Correct Approach – Part 2 Read Post »