Last Updated May 22, 2025

What is estimated Actual Cost of Work Performed (ACWP)?

Estimated ACWP is an adjustment to the actual cost data imported into the EVM cost tool as the Actual Cost of Work Performed (ACWP) to align ACWP with Budgeted Cost for Work Performed (BCWP). Estimated ACWP is synonymous with “estimated actuals.”

Why is Estimated ACWP necessary?

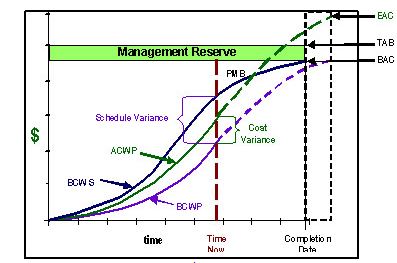

Without Estimated ACWP, timing mismatches between ACWP and (BCWP) cause false cost variances to be calculated in the EVM cost tool as well as from the data in the Integrated Program Management Data Analysis Report (IPMDAR) Contract Performance Dataset (CPD). Typically these variances are favorable and can mask other unfavorable variances. Additionally, if these variances exceed reporting thresholds, the explanations clutter the IPMDAR Narrative Report with variance explanations that discuss timing problems of the accounting system rather than actual performance issues.

When should Estimated ACWP be used?

Estimated ACWP is most typically required for material costs. For example, when BCWP is claimed upon receipt of the material, the payment for accrued costs in the accounting system typically occurs one or more months following material receipt, which creates the timing mismatch between BCWP and ACWP in the EVM cost tool. Other cost element types that may require Estimated ACWP include subcontracts and Other Direct Costs (ODC). Examples of ODCs that may require Estimated ACWP include staff augmentation, purchased labor, and travel.

How does Estimated ACWP function?

Receipt-type material:

- First, a determination must be made whether Estimated ACWP is necessary. For some categories of material, when a material item is received, the BCWP is claimed in the EVM cost tool. If actual costs for the materials do not enter the accounting system in the same period that the BCWP was claimed, Estimated ACWP is necessary to ensure ACWP occurs when BCWP occurs.

- Second, the Estimated ACWP adjustment is entered into the EVM cost tool as a current period transaction. The amount of the Estimated ACWP is based on the best information available for the material item (often accrued costs in the accounting system) using the invoice, purchase order, or receiving report.

- Third, the Estimated ACWP adjustment transaction is reversed in the EVM cost tool when the actual costs are recorded in the accounting system; this could be the following reporting period or later. If actual costs were to come in that month and the transactions were not reversed, the ACWP would be double-counted when the actual cost data from the accounting system is imported into the EVM cost tool. Also, the Estimated ACWP transaction should be recorded in a log to maintain traceability.

Production-type (inventory) material:

For production type materials, or materials that are common to many control accounts or even contracts, that go into inventory, earned value is claimed upon issuance from inventory, sometimes several months after receipt of the material and after the incurrence of actual costs in the accounting system. In this case, the opposite condition would exist. The accounting actuals occur before earned value is claimed for material. The EVM rules in the EIA-748 Standard for EVMS Revision D Guideline 21 or Revision E Guideline 14 (and common sense) state that ACWP is not to occur until BCWP takes place. Therefore, the accounting actual costs have to be “suppressed” from entering the EVM cost tool until material earned value is claimed. Since some companies say they cannot suppress actual costs, they let the actual costs enter the system, but make an off-setting “Negative Estimated ACWP” entry in the EVM cost tool until the material is issued and BCWP can be claimed for the material.

Do you need to implement an Estimated ACWP process in your Earned Value Management System? Humphreys & Associates has the earned value experts to assess your material management processes and to help you implement the appropriate procedures. Contact us today.

Accruing costs (estimated actuals) is perfectly acceptable as described above and needs to be reflected in the main accounting system (books of original entry). I believe that if such entries are made in a secondary/subsidiary/ reporting (MMAS/EVMS) application, that system becomes an extension of the G/L which must then also be fully integrated, backwards and forwards. The company is responsible to generate one “actual cost” value for the period, and I believe that is the audited, accounting G/L value. (Reference ANSI 748 Accounting Considerations #1.) Such G/L “actual” values are used for invoicing purposes and calculating overhead rates.

When Format 5 explainable schedule variances reveal deficiencies in the accounting or scheduling system, the solution is to fix those systems, not mask the issue by relying on PMO “estimated actuals.” The maintenance of a “second set of books” with different “actual costs” belittles the credibility of EVMS in the eyes of the customer and the public, even though this is a normal, explainable everyday business occurrence.

This is beneficial to use an estimated actual cost of work method .in earned value management.