A recent topic for the NDIA Integrated Program Management Division (IPMD) Clearinghouse was how to handle reporting fee for undefinitized work effort in the Integrated Program Management Report (IPMR) or Integrated Program Management Data and Analysis Report (IPMDAR). Undefinitized work is formally referred to as Authorized Unpriced Work (AUW) or Undefinitized Contract Actions (UCAs).

As a reminder, AUW/UCA is a contract scope change the customer’s contracting officer has directed to be performed. However, the scope, schedule and budget have yet to be fully defined and negotiated. A contractor typically creates a rough order of magnitude schedule and cost estimate which is their basis to develop a schedule and budget for the AUW/UCA scope of work.

As a reminder, the Contract Budget Base (CBB) is equal to the Negotiated Contract Cost (NCC) for definitized work plus an estimated cost for all AUW or UCAs. When all AUW/UCA work has been negotiated, the CBB equals the NCC. The CBB and PMB exclude any fee or profit.

DoD Policy and Reporting References for Guidance

For this discussion, the following DoD EVMS or Data Item Description (DID) references provide general guidance on how to report AUW/UCA, Target Profit/Fee, Target Price, and Estimated Price values for performance reporting. These references do not use the term “undefinitized contract actions.” They do use terms such as “undefinitized work” or “undefinitized change orders (known as AUW).”

- DoD Earned Value Management System Interpretation Guide (EVMSIG) (March 2019) includes this definition for Authorized Unpriced Work (AUW), emphasis added.

“A contract scope change which has been directed by the Government contracting officer but has not yet been fully negotiated/definitized. It includes a value, excluding fee or profit, typically associated with the authorized, unpriced change order.”

- IPMR DID DI-MGMT-81861A (September 2015). See Section 3.0. IPMR Format Content Requirements, 3.2.1. Contract Data, emphasis added.

“3.2.1.3. Estimated Cost of Authorized, Unpriced Work (AUW). Authorized, Unpriced Work is approved work scope that has not been definitized. The total dollar value (excluding fee or profit) of AUW shall be entered in Block 5.c.

3.2.1.3.1. The value of AUW is the value of the scope that was coordinated between the contractor and the Program Office, and authorized by the Procuring Contracting Officer (PCO).”

“3.2.1.4. Target Profit/Fee. Enter in Block 5.d the applicable fee that applies to the negotiated cost of the contract.

3.2.1.5. Target Price. Enter in Block 5.e the target price (negotiated contract cost plus profit/fee) applicable to the definitized contract effort.

3.2.1.6. Estimated Price. Based on the contractor’s most likely estimate of cost at completion for all authorized work, including the appropriate profit/fee, incentive, and cost sharing provisions, enter in Block 5.f the estimated final contract price (total estimated cost to the Government). This number shall be based on the contractor’s most likely management EAC in Block 6.c.1 and normally will change when the EAC is updated and/or when the contract is revised.”

- IPMDAR DID DI-MGMT-81861C (August 2021) has similar language. See Section 2. Document Requirements. 2.3 Contract Performance Dataset (CPD). 2.3.1 Heading Information, emphasis added.

“2.3.1.2 Estimated Cost of AUW. Provide the total dollar value (excluding fee or profit) of the approved work scope associated with AUW. AUW is a contract scope change that is directed by the Government contracting officer, but has not yet been fully negotiated/definitized.

2.3.1.3 Target Fee. Provide the applicable fee that applies to the NCC.

2.3.1.4 Target Price. Provide the target price (NCC plus target fee) applicable to the definitized contract effort.

2.3.1.5 Estimated Price. Provide the estimated final contract price. The estimated price shall be based on the contractor’s Most Likely Estimate at Completion (EAC) for all authorized work, including: the appropriate fee, incentive, and cost sharing provisions.”

What is the issue?

This came up as a Clearinghouse topic because contractors wanted to make sure they are accurately interpreting their government customer’s guidance and they are consistent with industry best practices. The EVMSIG, IPMR DID, and IPMDAR DID all state that AUW “excludes fee or profit.”

There are also implications for reporting the Best Case, Worst Case, and Most Likely Management EAC in the IPMR or IPMDAR. You may have noticed in the DID text above that the Estimated Price is based on the contractor’s Most Likely EAC for all authorized work plus the appropriate fee. While the DID says “all authorized work,” because the final cost has yet to be negotiated for the AUW/UCA, this creates questions. What value should be entered for the Estimated Price? Should it include fee or not for AUW/UCA?

H&A earned value consultants have seen contractors take two different approaches. To simplify and illustrate the two approaches, the following discussion uses the IPMR Format 1. The IPMDAR has similar heading information. The following examples assume a cost plus fixed fee (CPFF) contract.

Option One

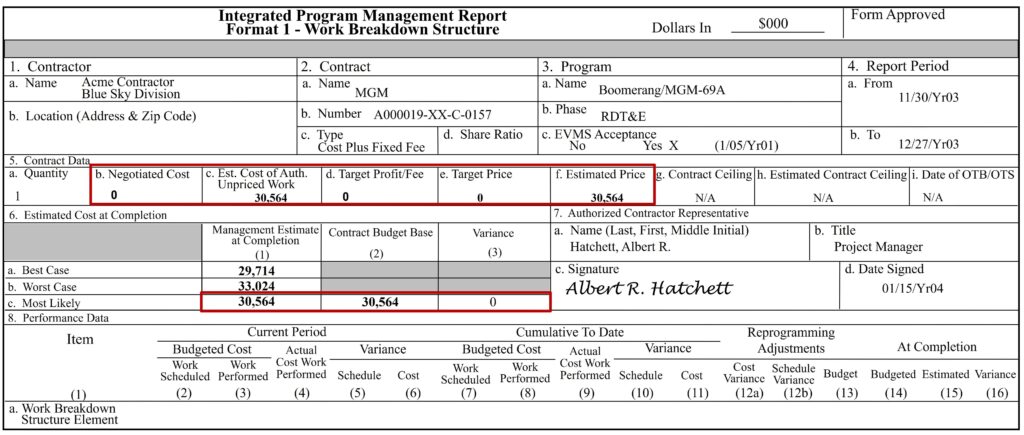

The most typical approach for projects is to enter the AUW/UCA amount in the IPMR Format 1 Block 5.c (Est. Cost of Auth. Unpriced Work) and include the same AUW/UCA amount in the Block 5.f (Estimated Price). The assumption is that when the AUW/UCA work effort is definitized, the contractor will negotiate the applicable fee with the customer during this process. A contractor should clearly state they intend to negotiate a fee for their AUW/UCA in their IPMR Format 5 or the IPMDAR Performance Narrative Report as well as in the transmittal letter accompanying the AUW/UCA estimate.

To illustrate how the heading data is entered in the IPMR Format 1 (Block 5.c and 5.f are equal), see Figure 1 below. This example assumes the entire contract is AUW/UCA to clearly illustrate the proper approach. Negotiated Cost (Block 5.b) is zero because the entire scope of work has not been negotiated. Target Profit/Fee (Block 5.d) is zero because AUW does not have profit/fee. Target Price (Block 5.e) is zero because the Negotiated Cost and Target Profit/Fee are zero. The Estimated Price, Most Likely Estimated Cost at Completion (Block 6.c (1)), and Contract Budget Base (Block 6.c (2)) are equal.

Example of a Format 5 narrative for this approach follows.

| Funding Status: Undefinitized Contract Action (UCA) contract value: $30,563,565. Current funding: $9,647,000. Significant Events:

|

Option Two

Another approach is to include the fee for the AUW/UCA value based on a long standing relationship with the customer. An example is a four year CPFF contract where a contractor can expect the same calculated fee when they negotiate the AUW/UCA. For a contractor with a proven history with the customer, they could reference a known historical fee percentage for similar work effort to document the assumed fee percentage in their transmittal letter with the accompanying the AUW/UCA estimate.

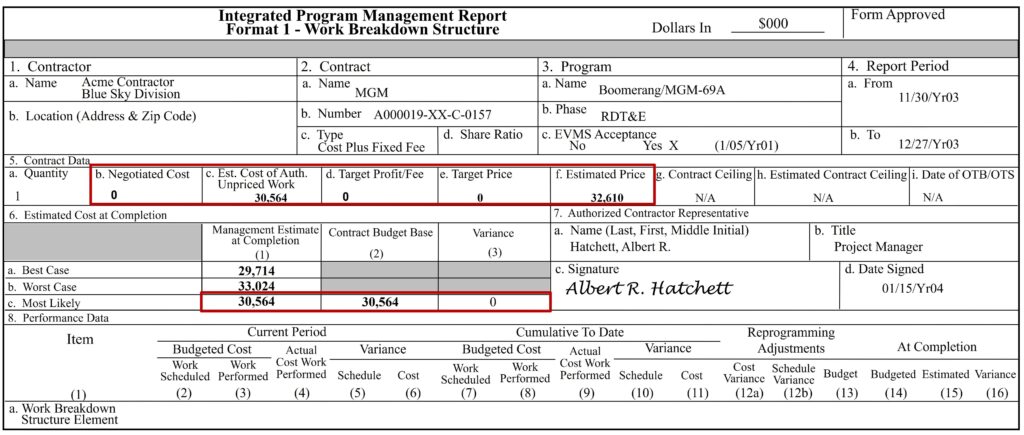

See Figure 2 as an example of including fee. The AUW/UCA amount would be included in the IPMR Format 1 Block 5.c. However, the Estimated Price in Block 5.f would include the profit/fee amount for the AUW/UCA. Also, the Most Likely Estimated Cost at Completion (Block 6.c (1)), and Contract Budget Base (Block 6.c (2)) are equal to the Block 5.c since they do not include fee.

Note: including the profit/fee amount in the Estimated Price is clearly in violation of the EVMSIG and IPMR/IPMDAR DIDs. Why this approach was taken must be addressed with the customer prior to report submittals. This action of including the fee in Block 5.f must be fully disclosed in the IPMR Format 5 or the IPMDAR Performance Narrative Report. This is required to reconcile the heading numbers. Example of a Format 5 narrative for this option two approach follows.

| Funding Status: Undefinitized Contract Action (UCA) contract value: $32,609,629. Current funding: $9,647,000. Significant Events:

|

Best Practice Tips

You are likely to encounter a more complex situation than the one illustrated in Figures 1 and 2 where some work scope has been defined and fully negotiated and other work scope is AUW/UCAs. Regardless of which option was used to report AUW/UCA and fee amounts, clearly explain the basis for the numbers in the heading information to ensure the customer is able to reconcile the numbers (Block 5 heading values highlighted in the red boxes in Figures 1 and 2).

Based on our decades of experience with all types of contractors and a variety of government agencies, here are few recommendations for you.

- Be sure your EVM System Description or related procedures explain how to handle AUW/UCA including how to report contract total values in the IPMR or IPMDAR for specific contract types.

- Verify your EVM training courses include a section on handling AUW/UCA and the rules that apply. It often helps to remind project personnel of the basic budget flowdown reconciliation math and which budget components include or exclude fee.

- Document how you intend to handle fee for the AUW/UCA in your proposal to ensure your customer clearly understands your intentions. Using the example of the option one approach discussed above, be sure to state your intentions to determine a fee amount once the work has been fully definitized and negotiated so the customer knows what to expect. Using the example of the option two approach above, reporting a fee for AUW/UCA amount before the work is fully negotiated is in violation of the EVMSIG and DIDs. Verify this approach is acceptable with your customer before you submit your reporting deliverables.

H&A earned value consultants often assist clients with EVMS and contracting situations where the government customer’s policy or other guidance can be subject to interpretation. Call us today at (714) 685-1730 if you need help determining the best course of action for your situation.