What Does it Mean When Somebody Says “We use EVM Lite” – Part 1

Here is why Humphreys & Associates takes an interest in the EVM Lite approach to Earned Value Management.

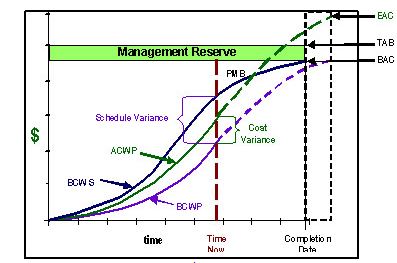

Earned Value Management (EVM) “lite” or EV Lite is a hot topic because people recognize that budgets versus actual costs are not meaningful enough for assessing true project technical/schedule/cost status. An awareness exists that there is a significant advantage to using Earned Value (EV) measurement to manage projects.

The EVM Lite approach is common for Independent Research and Development and Firm Fixed Price (FFP) projects. Therefore, it is important to understand what this term means.

EVM Lite is a title that could mean a combination of any of the following:

- Relaxation of the level of detail (fewer control accounts of larger size, fewer work packages of larger size with less milestones/technical achievement points and more dependence on subjective earned value techniques )

- Less rigor in approvals for Work Authorization Documents (WAD) and Budget Change Requests (BCR)

- Less rigor in Rolling Wave Planning and enforcement of the freeze period

- Less rigor in the variance analysis process, including looser variance thresholds

- Compliance with only the 16 “critical” American National Standards Institute, EIA-748 Guidelines

- Earned Value Management System (EVMS) not subject to third party verification

- Less detail in the EVM System Description (fewer examples, no “live” data examples)

- EVMS Cross Reference Checklist only at the Guideline level

EVM Lite implies an EVMS with relaxed requirements or a less rigorous approach that still meets the spirit and intent of the EIA-748 Guidelines. But it is important to note that none of the descriptions of EVM Lite above would pass muster in a DCMA review to determine whether a contractor’s EVMS complies with the EIA-748 Guidelines and cannot be used in that event.

If a contract mandates the use of an EVMS then EVM Lite is not an option. It is important to us our customers know this. However, if your contract does not mandate the use of EVM, then EVM Lite might be a viable option to pursue if management desires insight into their programs.

Part 2 – Tailoring Approaches to EVM Lite

What Does it Mean When Somebody Says “We use EVM Lite” – Part 1 Read Post »