Merging Earned Value Management System Descriptions

Are there best practices that apply when a company with an approved/certified Earned Value Management System (EVMS) acquires another company that also has an approved/certified EVMS in place? What happens with the EVM System Descriptions as well as related processes and procedures? What about the various project control tools being used? How do you level set the project control proficiency levels of personnel using the EVMS? Schedule and cost level of detail and data architecture also come into play. For example, project performance data is often used at the corporate level for financial analysis, portfolio analysis, and external reporting and may require data to be organized in a specific manner. Is the EVMS providing reliable status, forecast completion date (FCD), and estimate at completion (EAC) information to management?

What are your options?

H&A earned value consultants have observed different approaches and often assist companies with determining their strategy. Assuming you are the acquiring company, you could:

- Require the acquired company to use your EVMS.

- Let them continue using their EVMS for an agreed upon timeframe or indefinitely.

- Take the best of both and establish a new and improved EVMS.

Each option has its pros and cons. There are also other implications for at least the acquired company. DCMA will need to conduct an Integrated Baseline Review (IBR) and/or a compliance review if the acquired company’s EVMS assessment is no longer applicable. If you make significant modifications to your EVM System Description, DCMA will need to review the revised System Description to determine whether it still complies with the EIA-748 Standard for EVMS guideline requirements.

Things to Consider

- What do you want to achieve?

If the goal is to establish a common EVM System Description across the corporation, the strategy will need to reflect that. Define the business objectives that clearly articulate the benefits of using a standardized approach that can help to create and implement the plan to achieve your goal. In this example, that could narrow your path forward to either option 1 or 3 depending on the state of your EVMS. - What is the state of your current EVM design and System Description?

Do you already have a best in class corporate level system in place? If yes, option 1 is a good fit. The strategy would be to create a plan to transition the acquired company to your EVMS. A single EVMS is easier to maintain and to train people on how to use it effectively. Commonality makes it easier to move personnel between projects.

Perhaps your company is fine with different EVM Systems at a business unit level. For example, perhaps the business units have a different customer base (DoD versus DOE), and the requirements are different. In this case, it may make sense to go with option 2. We recommend being prepared to do an in-depth assessment of the acquired company’s EVMS to become familiar with it, gain an understanding of how project personnel use it, and evaluate the quality of the schedule and cost data. It is imperative that you have a good understanding of the strengths and weaknesses of the acquired company’s EVMS. You may find best in class practices that you could incorporate into your EVMS. On the other hand, you may discover issues you need to address with a corrective action plan. Some of them may be as simple as providing desktop instructions for the schedulers or control account managers (CAMs). The more difficult are actions taken to change the culture such as resistance to providing visibility into the data.

Option 3 may be good path in situations where you know there are components in your EVMS that need to be streamlined or enhanced. It provides an opportunity to fix known issues with your EVM design or System Description. It could also be an opportunity to replace a mix of software tools or home-grown tools with a standard set of commercial off the shelf (COTS) schedule, cost, and analysis as well as risk tools. Integration with a standard Agile tool may also come into play. In this case, your strategy may be to create a working group from both companies to create a best in class corporate EVMS. - Structure of the EVM System Description.

There may be “layers” to it that makes it easier to accommodate unique business unit environments. For example, perhaps you have established a corporate level System Description that states what the company does to comply with the EIA-748 guidelines when an EVMS is contractually required or what is required to satisfy internal management needs for project/portfolio analysis (no external customer management system or reporting requirements). The corporate level system should define specific rules all business units are expected to follow. The business units define how they comply with the corporate requirements (their specific process). A good approach is to also allow project managers to define project directives to specify project unique requirements as long as they comply with the corporate and business unit requirements.

In this example, option 1 is a good fit. The strategy would be to help the acquired company to establish revised EVM processes that align with the corporate requirements similar to other business units in the corporation.

Other Considerations

Your strategy and tactical plan must address identified risks and opportunities. A common challenge is resistance to change. A potential risk mitigation approach could be to bring in the acquired company’s personnel as part of a joint corporate management team with the goal to create a single best in class EVMS. It is essential to establish ownership in the new or revised process. An example from one H&A client illustrates the importance of taking ownership in the EVMS as part of a successful transition.

“We didn’t force what we had on them, nor did we give in. We have a corporate EVM System Description. When we acquired the company, we brought them in to do a revision of the System Description, as the decision was made that we will operate as one company. They are now using that System Description and are using the same EVM cost tool. We are working other initiatives to harmonize other systems. It was surprisingly not contentious. We incorporated their leads into the organization with minimal disruption. We also have corporate training, which they supported and some of their legacy folks are leading that. The company as a whole changed, rather than forcing our way on them. Not many major differences between us, but inclusion of the folks from the acquired company as well as business groups was key. Frankly, one of our legacy divisions was harder to work with than anyone from the company we acquired.” – EVMS Director, A&D Contractor

While this is an example of where things went well, your risk mitigation approach should be prepared for situations where the teams do not agree upon the documented process, tools, or training that could result in an impasse. Knowledge of the current internal environment and personnel mix can help to determine the best mitigation strategy. A strong leadership team must be in place to ensure teams are working to achieve common objectives and to amicably resolve differences with a target completion date.

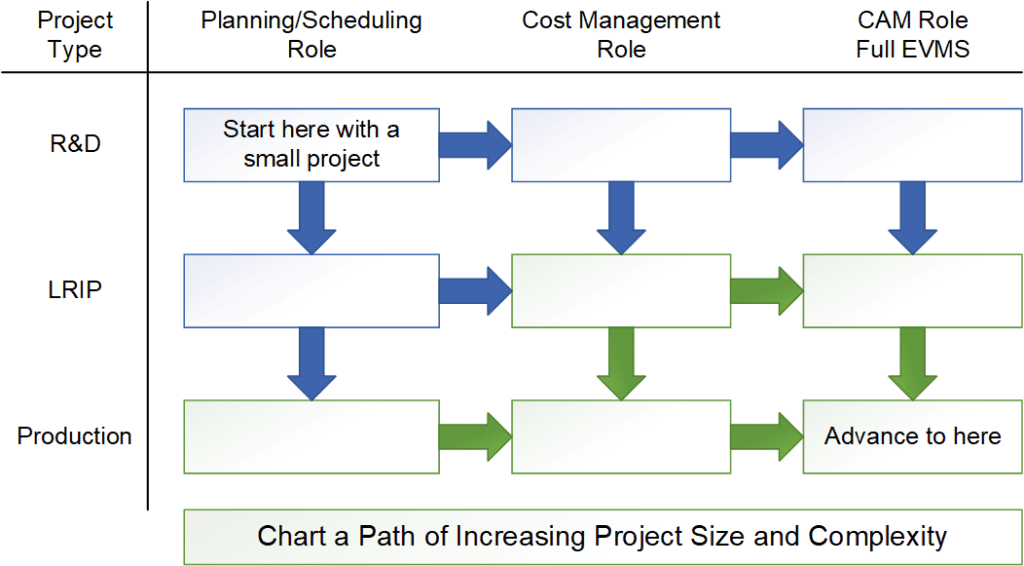

The tactical plan must also include a robust training plan that covers the revised EVMS process, procedures, and any new tools. This is critical to ensure project personnel gain a good understanding of what changed, who is responsible for what, workflow, requirements such as data coding or level of data detail, and how to use the tools effectively. Role based training is often useful to ensure project control personnel, schedulers, CAMs, and others are following the documented procedures specific to their day-to-day tasks. Desktop instructions are also useful to ensure project personnel are using the software tools effectively in alignment with the documented process and procedures.

What to do if you find yourself in this situation?

It often helps to start with a gap analysis of your or the acquired company’s EVM design and System Description as well as assess how project personnel implement the system and the quality of the data. H&A earned value consultants often conduct an EVMS gap analysis to provide a fact-based and independent analysis of the EVMS, project personnel proficiency levels, and quality of the schedule and cost data. Once you are able to identify and quantify the strengths and weaknesses of the system, you are in a better position to determine your best strategy that aligns with your corporate business objectives and goals.

Over the years, H&A earned value consultants have observed first-hand what strategies and tactics for designing and implementing a best in class EVMS ensures success in a variety of business environments. We can also help you avoid common pitfalls that can derail the best laid plans – it is often the case a client didn’t realize there were hidden risks, or they had made incorrect assumptions.

We can help you determine the right strategy for your situation. Call us today at (714) 685-1730 to get started.

Merging Earned Value Management System Descriptions Read Post »