Summary Level Planning Packages (SLPPs) Misnomer and Alias

Origins

One of the confusing terms in the world of Earned Value terminology is “Summary Level Planning Packages” or SLPPs. The term first appeared in Section 1 of the Earned Value Management Implementation Guide (EVMIG), published in 1996 which read:

Summary Level Planning Packages (SLPP) – “When it is clearly impractical to plan authorized work in control accounts, budget and work should be identified to higher WBS or organizational levels for subdivision into CAs at the earliest opportunity.” At this time, EIA-748 was still in draft form.

When 748-1998 was released, the SLPP reference was included with a slight modification to its use being limited to; “work scope for business reasons, is not yet allocated to responsible control accounts”.

With that being said, the term was never specifically included in the EVMS Guidelines (neither the original 35 criteria nor the initial 32 EIA Standard Guidelines)! The concept itself was again put forth in 748-B where the title changed to “Higher Level Account”, but the SLPP was still not referenced. With 748-C, the same phrasing is found. Throughout this time, Guideline 8 has not changed, where it continues to say (underlines added):

“Budget for far-term efforts may be held in higher-level accounts until an appropriate time for allocation at the Control Account level.”

Higher Level Accounts

The term was “Higher Level Accounts” (HLA if you prefer an acronym), and that is the only mention in any of the Guidelines themselves. In their 25 June 2015 Cross Reference Checklist, however, the DCMA felt the need to clarify the term in several spots:

8.a.(2) Higher level WBS element budgets (where budgets are not yet broken down into control account budgets) also known as a Summary Level Planning Package?

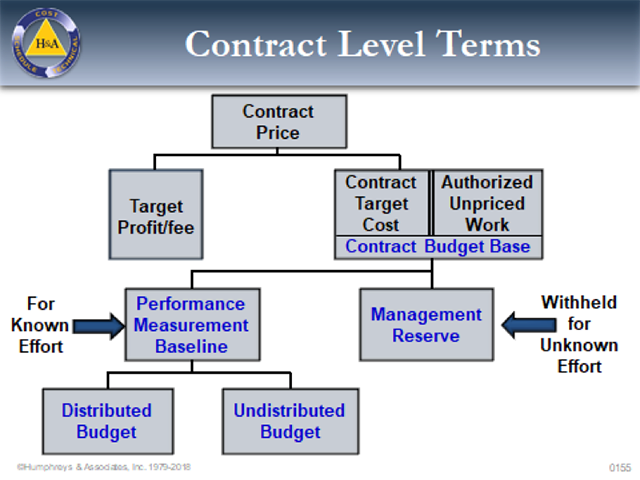

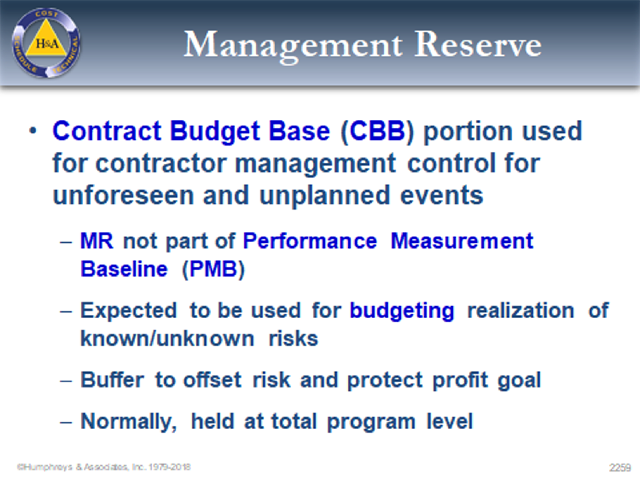

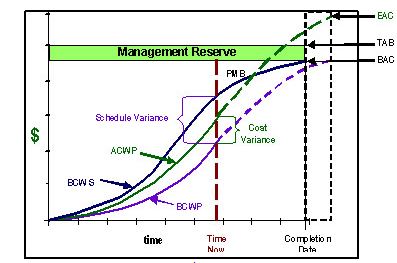

- b. Does the Contractor’s system description or procedures require that the sum of control accounts, Summary Level Planning Package (SLPP) budgets, Undistributed Budget(UB), and Management Reserve(MR) reconcile and trace to the CBB or Negotiated Contract Cost (NCC) plus the estimated cost of AUW) for any recognized OTB?

- b. Are ETCs developed at the work package, planning package, and Summary Level Planning Package (SLPP) levels, or where resources are identified if lower than the work package level?

- j. Are VACs calculated and analyzed with corrective actions at the control account (at a minimum) and Summary Level Planning Package (SLPP) levels?

Created to Help

The term “Higher Level Accounts (HLA)” was created to help contractors comply with the government requirement to distribute budgets from Undistributed Budget (UB) within two full accounting periods after definitization of the contract value. Many contractors on large, long term contracts were struggling with distributing work and budget for far-term effort about which they were not yet sure where or by whom the work would be performed.

The government allowance to create Higher Level Accounts enabled the contractors to “distribute” the scope and budget to an account – as though it were a Control Account – where someone would “tend it” until the contractor could better define where and by whom the work would be performed. While in the HLA status, the assigned higher-level manager (the PM or a functional manager designee) would be responsible to ensure the time phasing of the high-level budget was current and that the EAC for the work in the HLA was up to date (rates and time phasing ). Once the contractor determined the appropriate Control Account Manager responsible for getting the work performed, the scope, schedule, and budget in the HLA would be transferred (distributed) from the Higher Level Account to the Control Account.

Misnomer

As stated earlier, the origin of the term “Summary Level Planning Package – SLPP” is not really known, and it is really a misnomer:

- It is not a Summary Level (i.e., other Control Accounts do not summarize into it).

- It is really not a Planning Package (the responsible Higher Level Manager does not perform any planning for the work in the HLA – it is just a holding point until it can be distributed to, and planned by, the ultimate CAM).

This last point is where some people become confused. Being called a “Planning Package,” some people think the SLPP is part of a Control Account that is at a higher level within the Control Account than a Planning Package. That is another distinction between an SLPP (HLA) and a Planning Package – an SLPP can NEVER be directly detail planned into Work Packages. The budget in an SLPP must be transferred to a Control Account for that CAM to detail plan the work as necessary over the period of performance of the Control Account.

To be fair to the CAM receiving the HLA/ SLPP scope, schedule, and budget, the project should also have a “Rolling Wave Planning” approach for the HLA/SLPP, one that is at least 30 days in advance of the normal CAM Rolling Wave Planning process. This would give the CAM time to incorporate the work and budget time phasing into the Control Account (generally in one or more Planning Packages within the Control Account) in order to then be prepared for any necessary detail planning into Work Packages as part of the normal Rolling Wave Planning process.

Final Thought

Some people do not even consider Higher Level Account to be an appropriate description since the HLA/ SLPP is essentially at the same level as the Control Account. The “Higher Level” aspect means it is assigned to a higher level manager than a Control Account Manager (CAM) for that manager to “tend to” the scope, schedule, and budget until it is distributed to a CAM.

So even though HLA is what it is, SLPP is what it has become.

Higher Level Accounts or Summary Level Planning Packages can be confusing and often an area where projects need some help. A Humphreys & Associates EVM Consultant can provide the guidance you need for your unique production or development project. Please contact us for more information.

Summary Level Planning Packages (SLPPs) Misnomer and Alias Read Post »