Review Part 1 of Corrective Action Responses addresses Planning and Closure

Responding to a Corrective Action Request (CAR)– Planning and Closure

It is important that the contractor develop a disciplined, standardized approach for responding to a corrective action response. This not only helps ensure that the responses are complete and contain compliant corrective actions, but that they also represent the position of the entire contractor team. Below are nine suggested steps for successful Corrective Action Plan (CAP) development.

1) Review the DRs/CARs with the customer

Prior to developing a corrective action in response to a Corrective Action Request (CAR), the first step is to ensure that both parties, the contractor and the review team, have a mutual understanding of the finding. This also serves to screen those findings that may have been the result of a misunderstanding with the data or an incorrect statement from a member of the contractor’s team. It is also recommended that DRs/CARs with similar or duplicative findings be grouped together so that a single Corrective Action Plan (CAP) can be used to address the issue. When doing this, it is imperative that this approach is communicated to the review team lead and the grouping strategy approved before beginning corrective actions. This is generally an acceptable approach providing the CAP closures can be traced to the original findings.

2) Organize for successful CAP management

Once a mutual understanding has been reached on the corrective actions, the contractor must then begin the process of correcting or mitigating the identified issues. It is critical that the process of corrective action has the participation of key management and organizations that can affect change. When there are a significant number of findings that are to be corrected, the establishment of a senior management Review Board is a recommended method for managing the process. The roles of the board are:

-

- Ensure a CAP is developed and supported by a structured CAR/DR resolution process;

- Assign an individual from the responsible organization to lead the corrective action efforts;

- Review the proposed schedule for the CAP, and monitor progress towards CAP closure;

- Review and approve all CAR/DR root cause assessments and proposed corrective action including the closure criteria;

- Serve as the primary point of contact with the Customer for CAR/DR resolution and closure.

3) Begin a thorough Root Cause Analysis

A tempting direction at this stage is to allow for a quick fix of the identified issue. This may be acceptable for “just fix it” types of findings such as typos, formula errors, incorrect data runs, etc.; but most findings require a more in-depth approach to ensure that the underlying drivers of the issue are being addressed. Most organizations have employees who are specialized in root cause analysis, such as Six Sigma or LEAN process improvement advisers. This would be a good time to employ their skills. Tools such as “The 5 Whys” and the Ishikawa Fishbone Diagram are excellent methods for identifying the root causes. These tools and processes are extremely effective in uncovering the sources of the problem.

A customer review team often samples a subset of CAMs, processes, or data in its review because of a limited amount of time or resources. It is often the case that a more thorough root cause analysis conducted by the contractor team will uncover additional issues that need to be addressed and corrected. The contractor’s obligation to the customer is to provide full visibility regarding the corrective actions associated with those findings identified by the customer. While it is important that all issues are corrected or mitigated, it is, however, the contractor’s choice to allow visibility into those issues that were not discovered by the customer review team.

4) Develop and evaluate Corrective Action Plans

A single DR or CAR issued by a customer team may have numerous corrective actions identified in the solution process. Often a single problem may have corrective actions that entail changes in processes, training, tools, or management approach, or any combination of all of these. Regardless, it is important to identify corrective actions that will prevent recurrence of similar outcomes, and will not cause or introduce other new or additional problems. One important benefit of including senior management in the CAP Review Board process is the capability to reach beyond the owners of a particular CAP to influence other stakeholders in the organization who have the responsibility to incorporate corrective actions or who may be impacted by the solutions being identified.

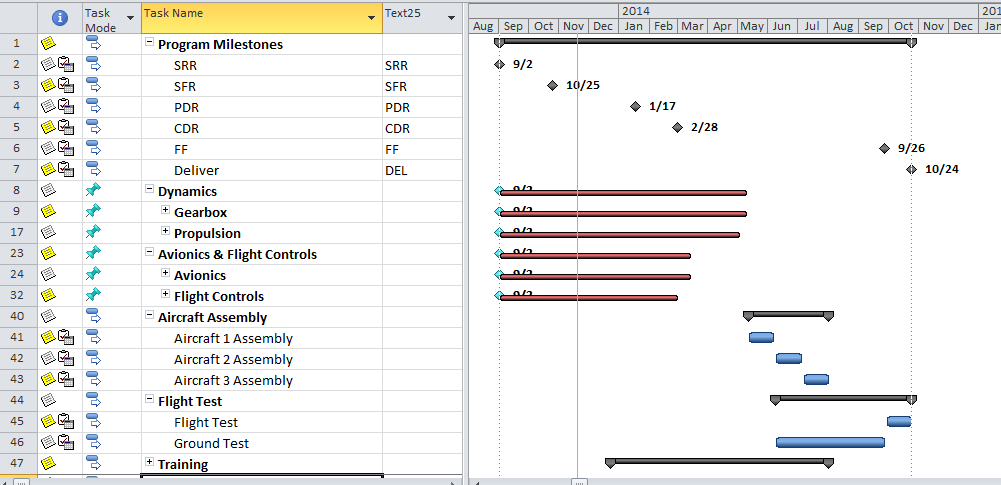

5) Develop verification closure steps

It is critical that verification methods, objective measures, metrics, artifacts, and evidential products are identified that will verify that the corrective actions are effective. This includes any exit criteria for any activities in the CAP Integrated Master Schedule (IMS), which is a schedule network that contains all the detailed work packages (including activities and milestones) and planning packages to support the events, accomplishments, and criteria of the Integrated Master Plan (if applicable). It is directly traceable to the Contract Work Breakdown Structure (CWBS) and the contract statement of work. The IMS is critical to CAP success. On data driven findings, the criteria for verification often involves producing several accounting periods of results as evidence that the corrective actions were effective. The CAP Review Board is responsible for reviewing the status of the exit criteria, and verifying that the required objective measures have been satisfied.

6) Develop a detailed Integrated Master Schedule for CAP implementation

A critical component of any project, including corrective action development and implementation, is a detailed IMS containing the project scope and the required dates of completion. There should be a unique IMS for each CAP that includes:

-

- Root Cause Analysis

- Changes to processes, tools, training, and other required system adjustments

- Management Review and regular team meetings

- Responsibility assignment for each activity

- Development of products and artifacts which will demonstrate effectiveness

- Validation and Verification steps with Closure Criteria

Resource loading the IMS is an important process, as it communicates to the management team the required personnel to accomplish implementation of the Corrective Action Plans, and can serve as a commitment on its part to support the process until closure. If there is a lack of available resources available to support the process, this may impact the completion dates established for the corrective actions. All tasks should be logically networked (with predecessors and successors) without any constraints. Progress should be based on a 0 to 100% scale without subjective interpretation. As mentioned above, data validation normally requires several months of data submittals, and these deliveries should be milestones in the IMS. Completion milestones should include notifying the customer of corrective action implementation and confirmation by the customer that the implementation is complete. Each activity should also have fields which identify the CAR or DR number, the EV Process Area and Guideline, the responsible manager for the CAP, and a unique ID number for each task.

Reviewing the CAP IMS and the accomplishment status is a critical role of the CAP Review Board.

7) Submit CAP and CAP IMS to the customer for approval prior to implementing the Corrective Actions

While some corrective actions may be straight forward responses to simple findings, it is important to reach a mutual agreement of the CAP approach prior to implementation. Often the customer’s approval of the CAP is a required step before proceeding. Important in this agreement is consensus on the artifacts and data sets that will be delivered, along with the timing of the deliveries.

One topic that may need to be addressed with the customer review team is a cutoff date for data corrections. For example, it is important to reach agreement on the “as of” date for clean data, because changing historical data is usually an unnecessary step. Occasionally a corrective action is delayed until a new contract modification is implemented or a new contract baselined before a correction can be implemented and verified. These conditions need to be agreed upon with the customer prior to proceeding.

8) Implement Corrective Action Plans and track progress to successful completion

One path to the escalation of a CAR to Level IV*, and possibly the introduction of Business System payment withholds, is the failure to successfully implement an agreed upon Corrective Action Plan. Many organizations discover that the actual implementation of the approved corrective actions is the most difficult part of the process. Sometimes a successful plan will include interim modifications or fixes in the short term, with long term changes identified as well. If for example, the issue were with the integration between the MRP and EVM systems, an interim solution may involve a change in the interface or translation of data between the systems while in the long term a replacement of the MRP is required. It is important to have CAP solutions that not only mitigate the findings, but also can also be implemented in an acceptable period of time.

It is also important to meet interim commitments of data, processes, or any agreed to delivery of an artifact. If the execution of a CAP will be delayed for any reason, this should be communicated quickly to the customer.

9) CAR closure and follow-up

When the issuer of the CAR is satisfied that the contractor’s corrective actions are appropriate to prevent recurrence of the noncompliance, and the solutions have been verified to be effective, the contractor will be notified that the CAR is considered closed. Even after closure, the areas identified as needing improvement are often targeted for periodic follow-on reviews; so it is important that management attention is maintained to sustain the corrective action. A well organized and disciplined internal surveillance program is often the best safeguard against future discrepancy reports.

For more information about responding to Corrective Action Requests, contact our consultants at Humphrey’s & Associates.

*Link to part 1 of Corrective Action Response: Sources

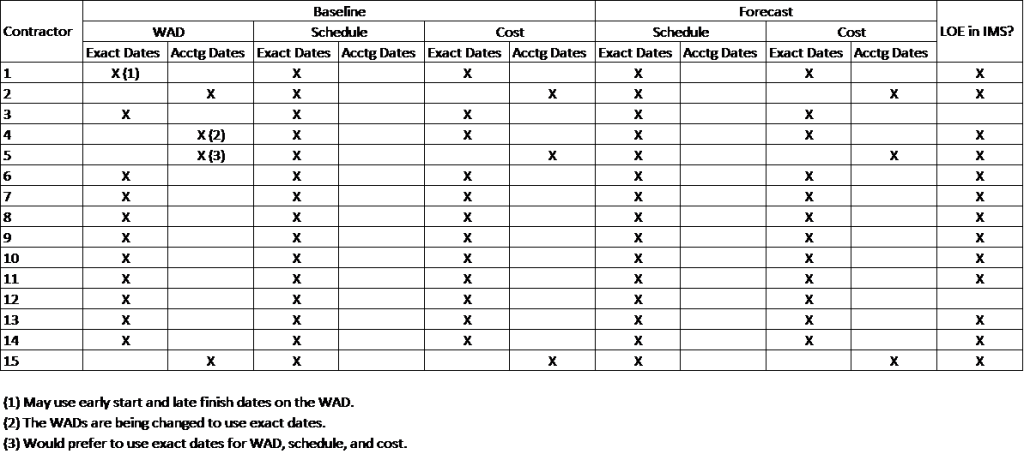

The EVMS Guidelines, and other guidance, are not specific as to whether exact dates must be used to demonstrate system integration between the Work Authorization Document (WAD), Integrated Master Schedule (IMS) and Control Account Plan (CAP), or whether the use of accounting month start and complete dates meets the spirit and intent of the EIA-748 requirement.

The EVMS Guidelines, and other guidance, are not specific as to whether exact dates must be used to demonstrate system integration between the Work Authorization Document (WAD), Integrated Master Schedule (IMS) and Control Account Plan (CAP), or whether the use of accounting month start and complete dates meets the spirit and intent of the EIA-748 requirement.