Variance Analysis, Corrective Action Plans, Root Cause Analysis

Variance Analysis “provides EVMS contract management with early insight into the extent of problems and allows corrective actions to be implemented in time to affect the future course of the program.” [NDIA ANSI EIA 748 Intent Guide] Department of Defense Data Item Descriptions: DI-MGMT-81861, Integrated Program Management Report (IPMR) paragraphs 3.6.10xx; DI-MGMT-81466A, Contract Performance Report, paragraph 2.6.3; and DI-MGMT-81650, Integrated Master Schedule (IMS) — paragraph 2.5 — all require analysis for significant variances including cause, impact and corrective action plans. By comparing the performance against the plan, it is possible to make mid-course corrections which assist completion of the project on time and within the approved budget. The Variance Analysis Report (VAR) is a “living, working document to communicate cause, impact and corrective action”. [See: Chapter 35 Variance Analysis and Corrective Action, Project Management Using Earned Value, Humphreys & Associates, page 707.] Well-written variance analyses should answer the basic questions of why, what and how.

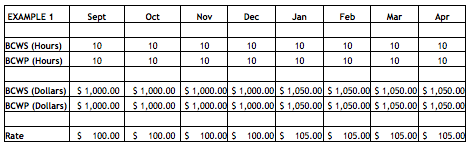

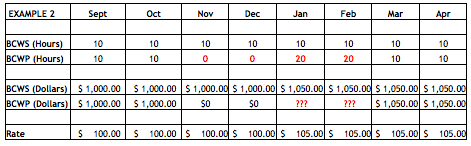

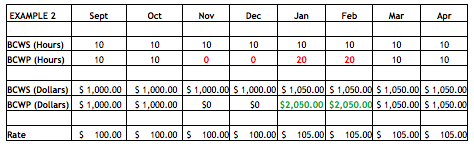

Cause is also known as root cause, nature of the problem, problem statement, issue, or problem definition. Root cause is the fundamental reason for the problem. Root cause is required in order to take preventative corrective action. The explanation of the variance is broken down into each of its components: discuss schedule variances separately from cost variances; discuss labor separately from non-labor; discuss which portion of the variance was caused by efficiency (hours) and which portion was because of dollars (rates) or if the variance was driven by material discuss how much was because of price and how much was because of usage. For more information refer to Humphreys & Associates blog Variance Analysis-Getting Specific.

Once the root cause of the problem has been identified and described, the impact(s) on the project should be addressed. Identify impacts to customers, technical capability, cost, schedule (including when the schedule variance will become zero), other control accounts, program milestones, subcontractors, and the Estimate at Completion, including rationale.

A corrective action (CA) plan should be developed that describes the specific actions being taken, or to be taken, which includes the individual or organization responsible for the action(s). The corrective actions should be directly derived from root cause analysis and related to each identified root cause. Results from previous corrective action plans should be included. Occasionally, a successful plan will include interim modifications or fixes in the short term, with long term changes identified as well. When no corrective action for an overrun is possible, an explanation and EAC rationale should be included. A corrective action log should be used that tracks the actions taken and the status of the corrective plan for each variance analysis cycle. As was stated in the Humphreys & Associates article: Corrective Action Response: Planning and Closure – Part 2 of 2 “It is critical that verification methods, objective measures, metrics, artifacts, and evidential products are identified that will verify that the corrective actions are effective.” Corrective action plans based on clearly a defined root cause facilitates time management action and avoids the occurrence of repetitive problems.

Variance Analysis, Corrective Action Plans, Root Cause Analysis Read Post »