Creating a Scalable Earned Value Management System (EVMS)

Creating a scalable Earned Value Management System (EVMS) is a topic H&A earned value consultants frequently encounter while assisting clients implementing an EVMS. These clients are often responding to a contractual EVMS requirement and are using it as the impetus to improve their project control system. A common theme is they would like to leverage the EVMS to win more contracts as well as increase project visibility and control to prevent cost growth surprises that impact their profit margins. They consider having an EVMS in place to be a competitive advantage.

Depending on the company size and their line of business, they typically have some project controls in place. They also realize they have gaps and processes are ad-hoc. They lack a standard repeatable process project personnel can follow. And that’s where H&A earned value consultants play a role – to help the client focus on the basics and simplify the process of implementing an EVMS that can be scaled for all types of projects.

What is a scalable EVMS?

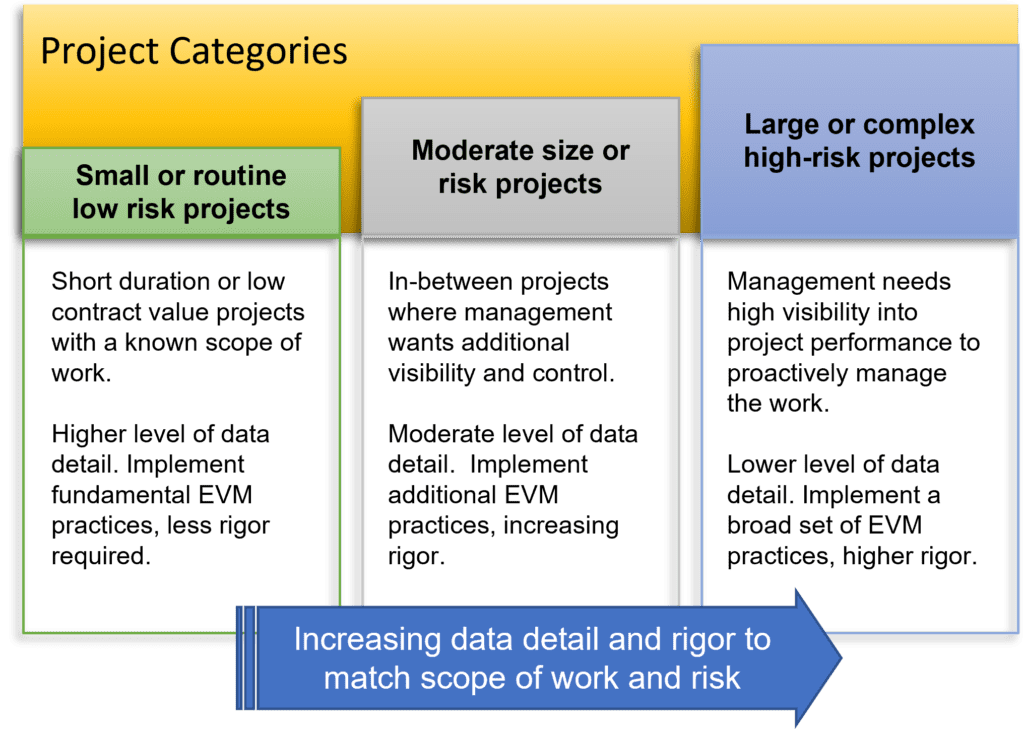

A scalable EVMS is a flexible project control system that incorporates earned value management (EVM) practices for all projects. The level of data detail, range, and rigor reflect the type or scope of work, size, duration, complexity, risk, or contractual requirements. This is illustrated in Figure 1.

Establishing a Common Base for All Projects

The foundation for a scalable EVMS is to establish a common project control system that incorporates EVM practices. Identify which practices apply to all projects and which practices apply based on the scope of work and risk as well as the level of data detail needed for management visibility and control. Identify and quantify project attributes so it is clear what is expected.

Use this information to create guidance for project personnel so they know what is required for their project. Include this guidance in the EVM System Description.

What are the steps to create a scalable EVMS?

Step 1 – Determine the project categories.

These will be specific to your business environment. The goal is to establish a small set of clearly defined project categories as illustrated in Figure 1. Identify measurable project attributes so a project manager can easily determine their project category. An example is illustrated below.

| Project Attribute | Small, low risk projects | In-between projects | Large, high-risk projects |

| Scope of work | Routine, repeatable tasks. Well defined. | Mix of known and unknowns. Some requirements are well defined, others likely to evolve. | High percentage of unknowns. Near term requirements are defined. TBD requirements are progressively defined. |

| Size (contract value is a typical measure) | < $20M | = or > $20M and < $50M | = or > $50M |

| Duration | < 18 months | > 18 months | > 18 months |

| Overall risk assessment, threat of schedule slip, cost growth or lower profit margin | Low | Moderate | High |

| Resource availability, skill set requirements | In-house resources are available, able to match demand | In-house resources are available, manageable number of specialized resources that may require out-sourcing. | Some in-house resources available. Must hire additional resources with specialized skill sets or out-source. |

| Percentage (or value range) of subcontract work effort | < 30% | = or > 30% and < 50% | = or > 50% |

| EVMS FAR or DFARS clause on contract, reporting DID | None | Potential for IPMR or IPMDAR DID deliverable | Included in contract, IPMR or IPMDAR DID deliverable |

Some contractors rank or apply a weight to the attributes useful for determining the level of data detail, range, and rigor of EVMS practices required. For example, the overall risk assessment and the scope of work may rank higher than other attributes. Step 2 builds on the project categories identified in Step 1.

Step 2 – Identify the level of data detail and EVM practices that apply.

This will be specific to your EVMS, EVM System Description, and how the content is organized. Include use notes to identify practices that may not apply or what can be scaled for the project category. A simple example is illustrated below. This example assumes core EVM practices are followed for all projects such as using a work breakdown structure (WBS) to decompose the scope of work.

| EVMS Components | Small, low risk projects | In-between projects | Large, high-risk projects |

|---|---|---|---|

| WBS, WBS Dictionary, project organization, control account level | High level. Control accounts are larger and longer duration. | Scale to match scope of work and risk | Lower level of detail. Depth dependent on scope of work and risk. |

| Work authorization | Simple workflow form and process with one or two approval levels. | Detailed element of cost workflow form, additional process steps, approval levels. | |

| Summary level planning packages | Usually not applicable. | Used when appropriate for scope of work. | |

| Work packages | Larger and longer duration. Fewer milestones, more percent complete earned value techniques (EVTs). | Shorter duration. Majority of discrete EVTs use milestones and quantifiable backup data (QBDs) to objectively measure work completed. | |

| Planning packages | Optional use. | Routinely used. | |

| Rolling wave planning | Usually not applicable. | Routinely used. | |

| Network schedules | High level. | Detailed. | |

| Schedule risk assessment (SRA) | Usually not necessary. | Required. Routinely performed. | |

| Variance thresholds | High level or simple. | Reflect contract or project manager requirements, scope of work, or risk level. | |

| Baseline change requests (BCRs) | High level, simple log. | Formal workflow process, forms, and logs to document changes and rationale. Approval levels depend on scope of the change. | |

| Change control board (CCB) | Not used. Project manager approves all changes. | Required. | |

| Risk and opportunity (R&O) management | High level assessment. May use simple R&O log. | Formal process to assess, R&O register maintained. | |

| Annual EVMS self-surveillance | Not applicable. | Required when EVMS on contract. |

Step 3 – Establish scalable templates or artifacts.

To complement the EVM System Description, provide a set of scaled templates or artifacts for project personnel. For example, a project manager for a small low risk project would select a simple work authorization or BCR form and workflow process, report templates, and logs to implement on their project. Provide a separate set of templates and artifacts for large high-risk projects that require additional procedures, data detail, workflow approval levels, forms, reports, and change tracking that can support an EVMS compliance or surveillance review.

Provide training on how to use the templates and artifacts. This helps to establish a standard repeatable process with a base set of artifacts. It also promotes a more disciplined process regardless of the type of project as personnel have a better understanding of what is required.

Another best practice is to use project directives to document the level of data detail, range, and rigor of the EVM practices implemented on a project. These provide clear direction for all project personnel on how to implement the EVMS. Project managers are often responsible for producing these. Create a template for each project category so they can easily document and communicate their management approach.

What are the benefits of establishing a scalable EVMS?

Establishing a common repeatable process along with a standard framework for organizing project scope of work, schedule, budget, and performance data enables project portfolio analysis to assess profitability. It also provides the basis to capture historical data a proposal team can use to substantiate their cost estimates. A common process eliminates the need to maintain different project control systems. It also makes it easier to move personnel between projects and increase the project control maturity level as everyone is following the same core processes – just the level of data detail or rigor of EVM practices may be different.

H&A earned value consultants have worked with numerous clients to design, implement, and maintain an EVMS. Scalability is a feature that can be designed into an EVMS and EVM System Description whether new or existing. Call us today at (714) 685-1730 to get started.

Creating a Scalable Earned Value Management System (EVMS) Read Post »