Integrating Subcontractor Data into an Integrated Master Schedule

Generating and maintaining a project’s Integrated Master Schedule (IMS) that meets management needs as well as customer requirements is difficult under the best of circumstances. The challenge becomes even more complex when subcontractor work effort must be incorporated. Issuing a subcontract is, in effect, handing off a portion of the work scope to an outside entity that becomes responsible for performing that work and meeting all technical requirements.

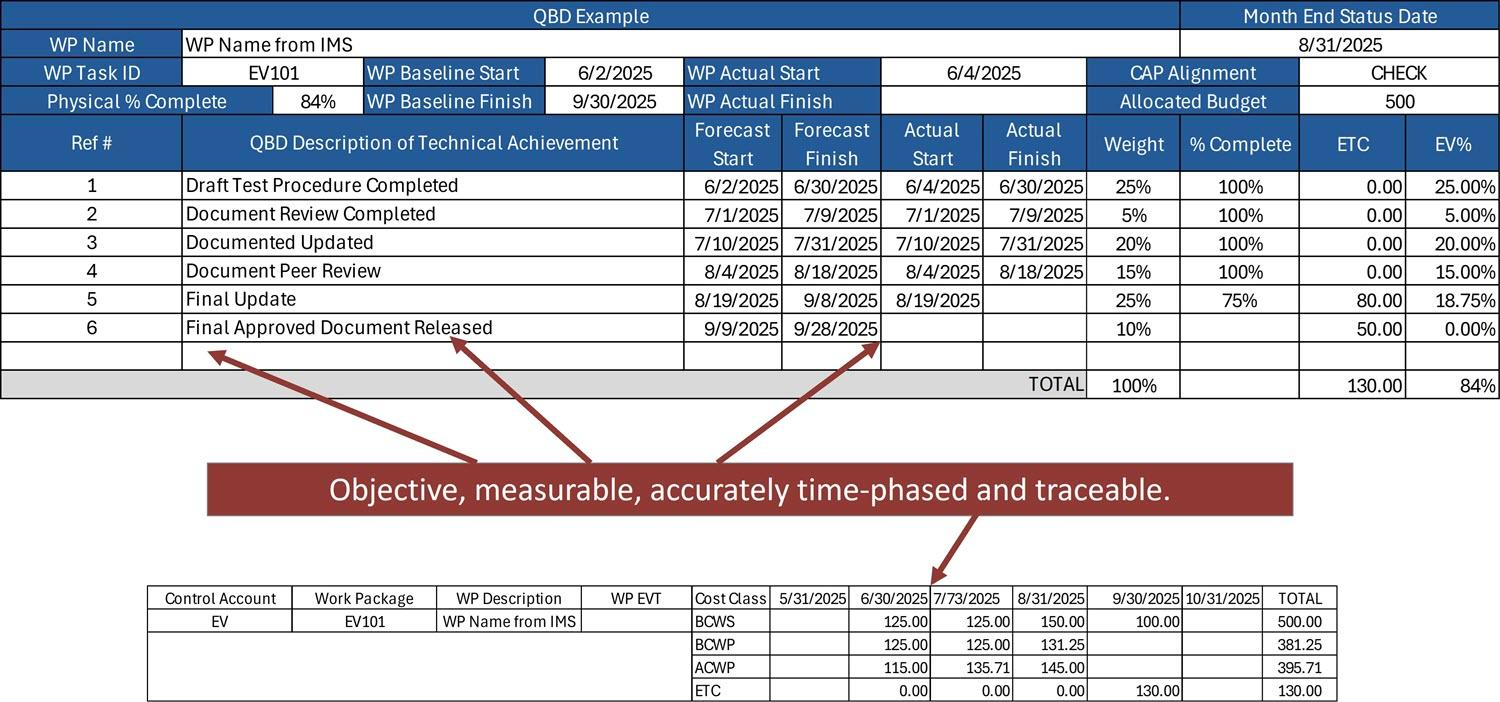

Another consideration for contractors where Earned Value Management System (EVMS) contractual requirements apply is whether the subcontractor is considered a major subcontractor because of the contract value, scope of work, or high risk factors. The EVMS requirements are flowed down to these major subcontractors; they will have the same contractual requirements and challenges as the prime contractor. Most subcontracts do not fall into this category. Many are small, short term, or firm fixed price (FFP) subcontracts.

Regardless of the category of the subcontractor, the subcontractors and the prime contractor all need an IMS to plan and coordinate work effort as well to measure progress. Using FFP subcontracts on development projects has the potential to increase risk significantly when expectations for scheduling rigor are not clearly defined.

A Real World Example

H&A EVM consultants supported a multi-billion dollar development project that illustrates the challenges with integrating subcontractor schedules into a prime’s IMS. The prime contractor had two major subcontractors with EVMS flow down requirements. They also had 22 FFP subcontracts without EVMS flow down requirements.

These FFP subcontracts were also mission-critical. The prime’s first priority was to define the required schedule format and data content in the request for proposal (RFP) to the subcontractors. Standardization was essential, along with specific instructions to ensure the schedule data could easily be incorporated in the prime’s IMS.

As the basis for a customized project specification, the team selected the Integrated Master Schedule (IMS) Data Item Description (DID) DI-MGMT-81650, an earlier DID that preceded the Integrated Program Management Report (IPMR) and Integrated Program Management Data and Analysis Report (IPMDAR) DIDs. The requirements were simplified and trimmed to selected sections in the DID for the detailed schedules. The document was assigned a specification number within the prime’s document management system so it could be used for future procurements.

Early Schedule Submittals: A Wake-Up Call

All the subcontractors dutifully proposed and were awarded subcontracts. The FFP subcontractors were required to submit initial schedules using the scheduling tool of their choice at the end of the first month of performance. To ensure compliance, the prime contractor tied the subcontractor’s first payment milestone to the acceptance (receipt, review, and approval) of their first schedule.

This turned out to be one of the best decisions made during project startup.

Those first schedules quickly revealed that many of the lower tier subcontractors had no experience developing logic-driven schedules that could comply with the reduced requirements document. They were unable to generate even the most basic project schedule. It was an eye opener to realize that while the first tier companies and most of the second tier companies did know about project scheduling, some of the second tier and all of the lower tier companies lacked that expertise.

The Solution: A Prime-Led Schedule Development Workshop

The prime’s schedule team, largely comprised of H&A schedulers, quickly initiated a week long on-site workshop open to all subcontractors who wanted help building their IMS. Every one of them signed up as they recognized acceptance of their schedule was a prerequisite for payment.

Prime contractor personnel were assigned to each subcontractor to help them build schedules that met the requirements. Most of the subcontractors were able to produce an acceptable schedule within the first three days. The other subcontractors required the full week.

The workshop approach provided two major benefits.

- The subcontractors gained experience in developing a logic-driven schedule that they could maintain and status. They had a better understanding of what the prime contractor expected them to provide.

- The prime’s schedule team gained a better understanding of each subcontractor’s scope of work and execution strategy. They had a better picture of the entire IMS as well as interdependencies. Without this knowledge, the next step of determining the best strategy to incorporate the subcontractor’s schedule data into the prime’s IMS would have failed.

Strategies for Incorporating Subcontractor Data into the Prime’s IMS

The NDIA Integrated Program Management Division (IPMD) Planning and Scheduling Excellence Guide (PASEG) is a useful source of information on scheduling best practices. The section on External Schedule Integration offers basic guidance on flowing down detailed scheduling requirements to subcontractors. It also provides a short list of things to consider, such as coordinating dates and change control:

“Status dates should be consistent between the prime contractor and supplier schedules. If the subcontractor’s schedule update is to a different point in time, it could potentially affect the IMS analysis results. If it is not possible to have consistent status dates between the various schedule elements then implement a strict process, with support of all parties, to manage the impacts.

Change control procedures are established and understood. The prime contractor should clearly communicate which type of schedule changes will require pre-approval before incorporation and which type will require coordination only or documentation upon submittal. The lack of a disciplined change control process can result in disconnects between the prime contractor and subcontractor’s schedule.”

Remember the prime contractor’s IMS includes a baseline and a current schedule. The complications can be significant when all the variables are considered such as calendars, mix of schedule tools and options, scheduling techniques, resource loading, and custom fields.

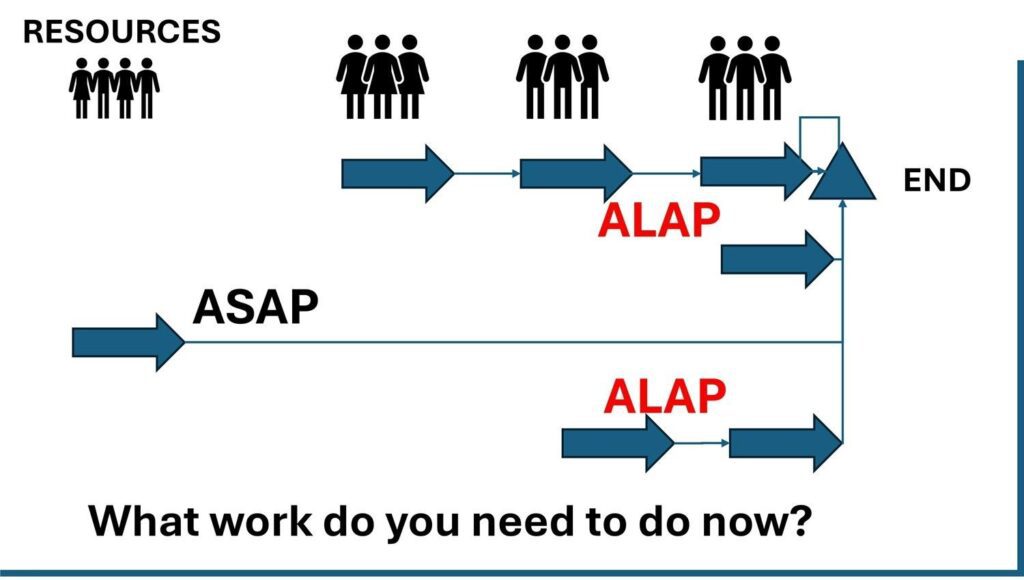

That still leaves the question of how to incorporate the schedule data from an external source into the prime’s IMS. The PASEG outlines three approaches.

- Full integration where the entire subcontract schedule is incorporated into the prime’s IMS.

Pros: Provides maximum visibility into the critical and driving paths as well as forecast completion dates.

Cons: Often not feasible with a large number of subcontractors. Mix of scheduling tools complicates the process.

Use Notes: This option is often reserved for major subcontractors or teaming partners. Works best when the prime and subcontractor are using a common scheduling tool or the subcontractor has direct access to the prime’s IMS scheduling tool to maintain their data. Otherwise, the prime must incorporate additional processes to import the external data into their IMS. There are other complications, as different schedule tools calculate dates differently, that will need to be handled in the integration process. - Using interface milestones.

Pros: Easier to implement and maintain. Yields the best results with less complex or lower risk subcontractors.

Cons: Provides less insight into the subcontractor’s current schedule performance. It does not easily support critical path analysis when paths run through subcontract work effort.

Use Notes: Requires the manual update of each interface milestone to reflect the latest forecasted dates from the subcontractor’s schedule. The prime must ensure their IMS is properly coded. Contractors often use “External Inbound” and External Outbound” codes along with a subcontractor code and any other codes needed to identify who is receiving/giving to whom. - Representative model. This is a middle ground approach between integrating the entire subcontractor’s schedule into the prime’s IMS and using interface milestones. Requires a summarization or representation of the subcontractor’s work to be entered into the prime’s IMS.

Pros: Provides a summarized version of the subcontractor work effort that retains enough schedule logic for critical and driving path analysis.

Cons: IMS content must be carefully entered and maintained to retain the required relationships to the external schedules for accurate critical path analysis. Requires a higher level of schedule discipline and a defined process to ensure the accuracy of the data between the external schedules and the prime’s IMS.

Use Notes: It is often beneficial to provide the subcontractor with a copy of their schedule that includes an extra column that identifies the prime’s task ID that is the “parent” of the summarized or consolidated work. In the initial IMS submission from the subcontractor, the prime added a custom field (Prime Parent ID). That IMS file was returned to the subcontractor, and the use of the special field was agreed upon. In each subsequent submission by the subcontractor, the prime team checked for tasks with no “Prime Parent ID” and added one that would allow integration. This kept the two companies’ schedules synchronized. If changes were made by the prime team that changed the field data in the subcontractor’s IMS, the changes were coordinated. A recommended practice is to group and sort the subcontractor schedule by the prime’s IDs to ensure that it is done properly.

What Worked for the Complex Development Project

In the situation described earlier, the schedule team determined a hybrid approach was the best solution, depending upon the subcontractor’s scope of work.

- The full integration approach was quickly eliminated; it was impractical. There were too many schedules, and some were too complex. It would have been a logistical nightmare.

- Selected simple FFP subcontract work effort was incorporated using the milestone method. The schedule milestones were carefully aligned to the payment plan milestones so that one set of milestones served both purposes.

- For the subcontracts with EVMS flow down requirements and the other subcontracts, including some FFP subcontracts, the representative model was used. The prime’s control account manager (CAM), responsible for the subcontractor’s scope of work, was required to condense the subcontract schedule into a representative model that made sense to the CAM. The most common ratio turned out to the 10:1, with 10 subcontractor tasks rolling up to 1 prime contractor IMS task, carefully maintaining the prime’s control account and work package structure. With proper coding, the subcontractor schedule could be easily reviewed and analyzed by the CAM as well as other project personnel.

Need help establishing strategies to integrate subcontractor schedule data?

Every project presents unique scheduling challenges, and the approach for integrating subcontractor data often needs to be tailored to fit the situation. H&A earned value consultants and master schedulers have seen and solved them all. With deep experience across diverse industries and project types, our experts deliver the insight and leadership needed to help contractors implement practical, results-driven solutions for integrating subcontractor data. Call us today to get started.

Integrating Subcontractor Data into an Integrated Master Schedule Read Post »